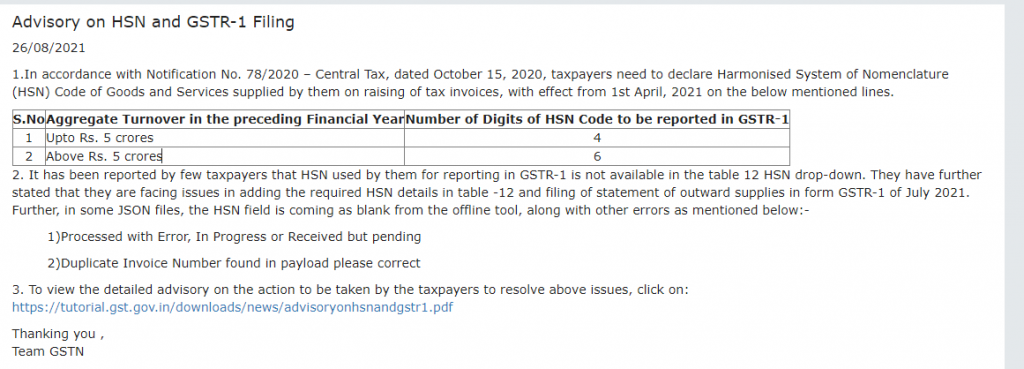

In accordance with Notification No. 78/2020 – Central Tax, dated October 15, 2020, taxpayers need to declare Harmonised System of Nomenclature (HSN) Code of Goods and Services supplied by them on raising of tax invoices, with effect from 1st April, 2021 on the below mentioned lines in GSTR-1 return (HSN Code In GSTR-1 Return)

| S.No | Aggregate Turnover in the preceding Financial Year | Number of Digits of HSN Code to be reported in GSTR-1 |

|---|---|---|

| 1 | Upto Rs. 5 crores | 4 |

| 2 | Above Rs. 5 crores | 6 |

3. To view the detailed advisory on the action to be taken by the taxpayers to resolve above issues, click on: https://tutorial.gst.gov.in/downloads/news/advisoryonhsnandgstr1.pdf

One Comment