Registration of Private Limited Company in India with foreign Directors and Members is more or less similar to that of normal private limited company with Indian Directors and shareholders except that if foreign nationals are incorporating a company in India there is compliance requirement of Companies Act, FEMA applicable in case of foreign nationals are required to be complied with, here we have listed some frequently asked questions on private limited company registration with Foreign nationals in India

Can two Foreign Companies form a Company in India?

Yes, representatives of these companies may be appointed as Directors in Indian Company, one of them should be Indian Resident.

Can a Company may be registered without any object?

No, as per Indian laws a Company must have a lawful object at the time of Incorporation.

Is foreign National is required to visit India for registration of Company?

No, Company registration is 100% online process, they just need to send scanned copy of documents required.

Is the Company required to hold Compulsory Board Meeting and if so does foreign national is required to come India for such meetings?

Yes, Company is required to hold 4 Board Meetings during the financial year BUT foreign directors are not required to visit India for attending the meeting. A meeting may be held through video conferessing.

Can registered office may be situated outside India?

No, it must be situated in India Only.

Can a foreign Company register a Wholly Owned Subsidiary Company in India?

Yes, a foreign company may do so but the new company must have a resident Indian Director.

Who is resident in India?

Every Company shall have at least one Director who has stayed in India for a total period of not less than 182 days in the previous calendar year.

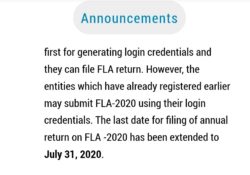

Is there is any RBI Compliance required to be done when there is Foreign Capital Inflow in Company?

In Sectors where 100% FDI is allowed under Automatic Route, there is no requirement for RBI Approval but Company is required to make reporting of these transaction to RBI to Authorized Dealer Bank.

What documents are required from Foreign National to get Digital Signature and Director Identification Number ?

Notarized or apostilled Copy (if a Commonwealth country) of Passport in support of address and identity proof along with duly.