PWD Contractor Licence is mandatory required to be obtained before applying for any Tender in Rajasthan for PWD Contractor work. Every person who is planning to apply for tender for government works must obtain a contractor’s license with PWD.

Minimum Requirements for applying for PWD Contractor Licence

The contractor must have Firm Registered, a Firm can be a proprietorship firm, company, Partnership or LLP ( you can choose any type of business entity) ( For Firm Registration with Fastlegal call 9782280098 or email: mail@fastlegal.in )

Obtain GST Registration :

Your Firm must have GST Registration ( for GST Registration call 9782280098 or email: mail@fastlegal.in)

Categories of contractors:

- Civil Contractors (entitled for construction of buildings, bridges, canals, reservoirs, filter plants, and other water sewerage schemes as well as other construction works)

- Furniture & Joinery Works Contractors

- Electrical Works Contractors

- Sanitary, Pipe Fitting, and Plumbing Works Contractors

- Painting Works Contractors

Application form for Registration: The application Form for Contractor Enlistment is required to be obtained from the Department with payment of Rs. 50

Class of Contractor and Amount of Work that can be done :

S. No. | Class of contractors | Extent upto which qualified to tender for any, work |

| 1 | AA class | Any amount |

| 2 | A Class | Upto Rs. 10.00 crores |

| 3. | B Class | Upto Rs. 5.00 crores |

| 4. | C Class | Upto Rs. 1.50 crores |

| 5. | D Class | Upto Rs. 30 Lacs |

Registration fee Contractor Registration :

Class of contractors | Amount of Registration Fee in Cash/Treasury Challan/Bank Demand Draft (Non-refundable) | Amount of Security Depositin form of Interest bearingDeposit/FDR of Bank |

| ClassAA | Rs. 45,000.00 | 12 Lakh |

| Class A | Rs. 33750.00 | 6 Lakh |

| Class B | Rs. 22500.00 | 3 Lakh |

| Class C | Rs. 9000.00 | 1.5 Lakh |

| Class D | Rs. 4500.00 | 75 Thousand |

Documents Required for PWD Contractor Licence

- Copy of PAN

- Copy of Aadhar Card

- Photograph

- GST Registration Certificate

- Address Verification of Firm/Company by police station/post/Councilor/Sarpanch (Verification must be attested)

- Affidavit of a close relative of Proprietor/All partners/Directors

- Two Certificates of work completed satisfactorily in last 3 years with work order and documents of T.D.S. deduction (26 A.S.) (amount in lacs)

- List of machinery, plant, and documents of ownership and list of working staff on the stamp of Rs. 50 / – (rent nomination of machinery on the stamp of Rs. 500 /with Ownership documents)

- Attested report(3B report) of the latest GST return

- Affidavit regarding Sales Tax on a stamp of Rs. 50/- and undertaking released by C.A.

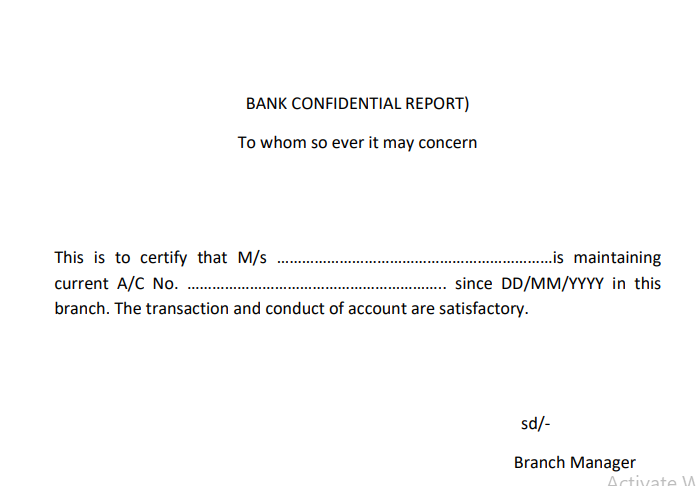

- Bank Confidential Report regarding

Bank Confidential Report Format :