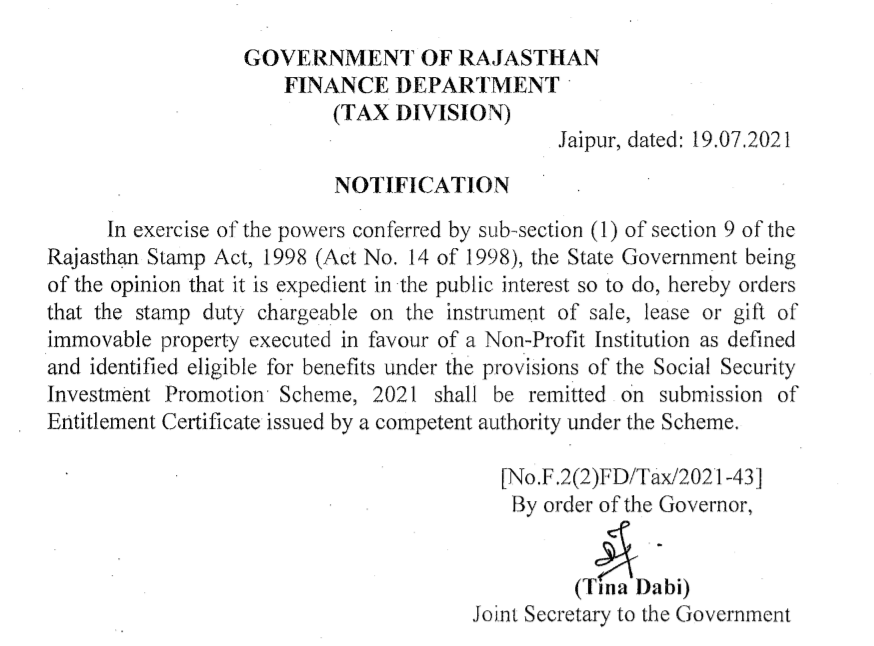

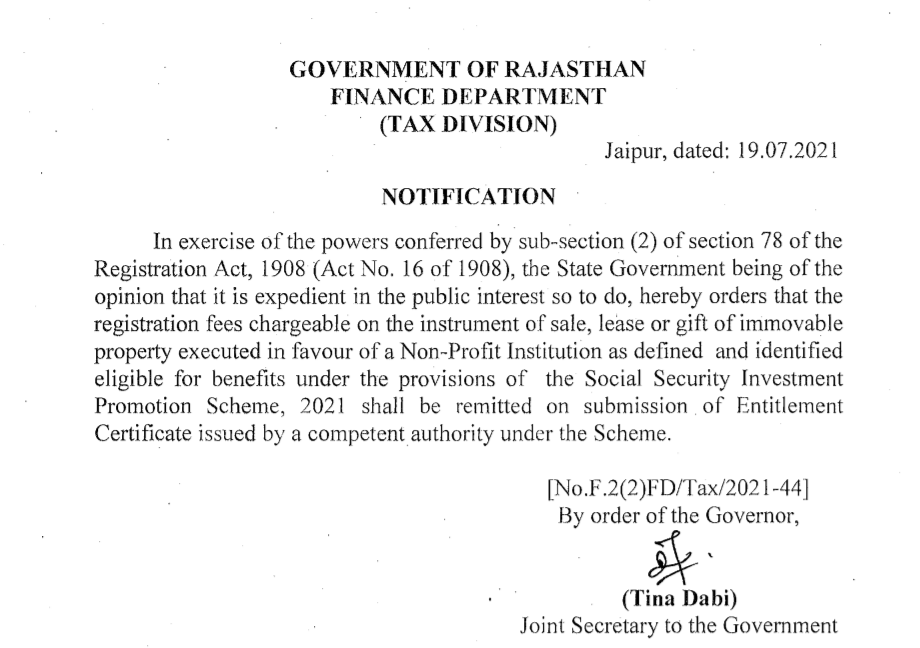

To Promote Social Investment in the state of Rajasthan Rajasthan Government on 19th July 2021 issued notification regarding exemption from Stamp Duty and Registration fee chargeable on the instrument of sale, lease or gift of immovable property executed in favour of a Non-Profit Institution. There are two separate Notifications for Stamp Duty and Registration Fee exemption to NGO, Only those institutions which Obtain Entitlement Certificate from Government will be exempted under this notification.

Link of Notification for Exemption in the Registration fee – Download

Link of Notification for exemption in the Stamp Duty – Download

Procedure to get Stamp Duty and Registration fee Exemption

Non Profit Institutions wants to get exemption from the above notification are required to obtain Entitlement Certificate online from Rajasthan Government, to get approval non-profit institution must already be registered as Trust, Society or Section 8 Company (NGO)

Documents required to apply for Entitlement certificate for Exemption

- Institution Reg. & Latest Renewal Certificate/ संस्था के पंजीकरण & अंतिम नवीकरण प्रमाणपत्र

- Audited certificate of the CA of the a/cs of the institution for last three FY/ पिछले तीन वित्त वर्ष के लिए संस्था के खातों के सीए का ऑडिटेड प्रमाण पत्र

- 12A Reg. Certificate/ 12ए पंजीकरण प्रमाणपत्र

- Reg. on Darpan Portal/ दर्पण पोर्टल पर पंजीकरण

- FCRA Reg. Certificate (if applicable)/ एफसीआरए पंजीयन प्रमाणपत्र (यदि लागू हो)

- PAN Card/ पैन कार्ड

- Details of current Executive/ Governing body of the Institution and Bye-laws/ संस्थान और उप-कानूनों की वर्तमान कार्यकारी / शासी निकाय का विवरण

- Annual Report of last three FY/ पिछले तीन वित्तीय वर्ष की वार्षिक रिपोर्ट

- Buyer-Seller Agreement

- Documents relating to immovable property in the name of the institution (only for Exemption under S.No. 1 to 6)/ संस्था के नाम पर अचल संपत्ति से संबंधित दस्तावेज (केवल क्र.स. 1 से 6 के तहत छूट के लिए)

- Copy of documents of land (only for Exemption S.No. 1-6)/ भूमि के दस्तावेजों की प्रतिलिपि (केवल क्र.स. 1-6 के तहत छूट के लिए)

- Bank Account Details

- Details of the Work being done for the Disadvantaged Class/ Section/ वंचित वर्ग/ तबका के लिये किये जा रहे कार्यो का ब्यौरा