- क्या है यह कंपनी फ्रेश स्टार्ट स्कीम – 2020 (CFSS-2020) में :

कंपनी फ्रेश स्टार्ट स्कीम -2020 ROC / MCA के साथ E फॉर्म भरने के लिए अतिरिक्त शुल्क के भुगतान के लिए छूट के लिए है और अभियोजन के लॉन्च से प्रतिरक्षा या जुर्माना लगाने की कार्यवाही

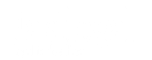

- कौन कौन से फॉर्म करे सकते है फाइल :

- कंपनियों जो वार्षिक Return और आरओसी / एमसीए यानी फार्म एओसी -4, एओसी-4 एक्सबीआरएल, एओसी-4 सीएफएस के लिए वित्तीय विवरण दर्ज नहीं करवाई हैलिए,फार्म MGT-7

- कंपनियों जो किसी भी ई फार्म कि करने के लिए दायर किया जाना आवश्यक है नहीं दर्ज कराई है आरओसी / एमसीए और दायर नहीं अर्थात फॉर्म एमजीटी -14, एडीटी -1, फॉर्म डीपीटी -3, फॉर्म डीआईआर -12, फॉर्म 20 ए, आईएनसी 22

- अवधि जिसके लिए रिटर्न सीएफएसएस-2020 के तहत तक दाखिल किया जा सकता है।

- 01-04-2020 से 30-09-2020

- शुल्क दस्तावेज दाखिल करने के लिए देय

- सामान्य फाइलिंग शुल्क

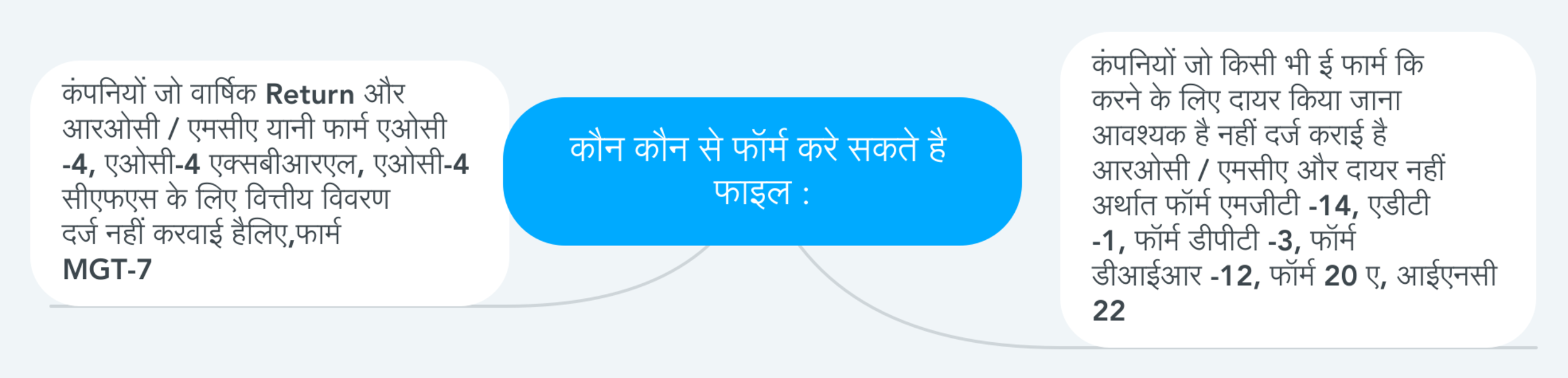

- क्या है फॉर्म सीएफएसएस -2020

- ई फॉर्म

- आवश्यक हैएमसीए के साथ दायर किया जाना चाहिए

- योजना के अंत के बाद6 महीने के भीतर

- ई फॉर्म सीएफएसएस -2020 के लिए कोई फाइलिंग शुल्क सीएफएसएस की-

- कंपनी जो इस स्कीम का लाभ नहीं ले सकती :

- कंपनी Strike off के तहत बंद

- Strike off कंपनियों

- प्रसुप्त कंपनियोंकी स्थिति प्राप्त करने के लिए दायर आवेदन

- लुप्त कंपनियों

- फोrm एसएच 7 अधिकृत में वृद्धि के लिए शेयर पूंजी

- फार्म CHG -1, CHG -4, CHG -8, CHG-9 का शुल्कसे संबंधित

- निष्क्रिय कंपनियों को क्या करना होगा :

–

- Dormant कंपनी की स्थिति प्राप्त करने के लिए आवेदन

- कंपनी जिसका नाम स्ट्राइक ऑफ के लिय आवेदन करना

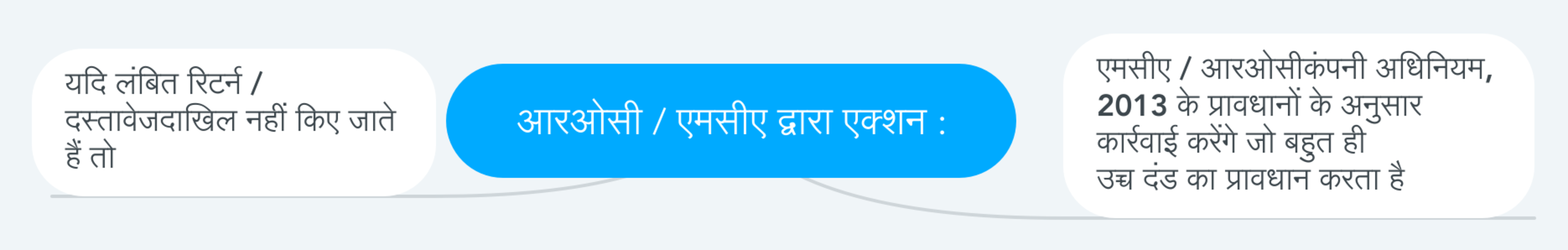

- आरओसी / एमसीए द्वारा एक्शन :

- यदि लंबित रिटर्न / दस्तावेजदाखिल नहीं किए जाते हैं तो

- एमसीए / आरओसीकंपनी अधिनियम, 2013 के प्रावधानों के अनुसार कार्रवाई करेंगे जो बहुत ही उच्च दंड का प्रावधान करता है