YouTube चैनल विज्ञापन व्यवसाय के लिए कानूनी पंजीकरण के लिए आवेदन कैसे करें

यदि आप YouTube चैनल चलाते हैं और विज्ञापनों या किसी अन्य रूप से अपने YouTube चैनल को व्यवसाय के रूप में पंजीकृत करने के लिए धन कमाते हैं, तो विज्ञापनों के माध्यम से पैसा कमाना एक विज्ञापन व्यवसाय है और आपको अपना पंजीकरण करना होगा भारत में पंजीकरण के लिए उपलब्ध किसी भी व्यावसायिक संरचना के साथ व्यापार, इस पोस्ट में मैं आपको भारत में YouTube चैनल के लिए कानूनी पंजीकरण प्रक्रिया के बारे में बताऊंगा:

व्यवसाय संरचना चुनना:

भारत में व्यवसाय विभिन्न प्रकार के व्यवसाय संरचनाओं के माध्यम से किया जा सकता है YouTube चैनल के पंजीकरण के लिए उपलब्ध है जो आपको उपलब्ध व्यावसायिक संरचनाओं के बारे में पता होना चाहिए:

प्रोपराइटरशिप फर्म व्यवसाय:

प्रोपराइटरशिप कोई भी एकल व्यक्ति जो व्यवसाय कर रहा है, अपने स्वयं के नाम के तहत पंजीकरण कर सकता है और प्रोपराइटरशिप फर्म अपने स्वयं के नाम से अलग इकाई में नहीं होगा। मालिक। यदि आप एक अकेले व्यक्ति हैं और YouTube पर विज्ञापनों के माध्यम से कुछ पैसा कमा रहे हैं, तो आप एक प्रोपराइटरशिप फर्म को पंजीकृत कर सकते हैं।

भारत में प्रोपराइटरशिप फर्म का पंजीकरण अनिवार्य नहीं है, लेकिन बैंक खाता खोलने के लिए बैंक आपसे आपके व्यवसाय के नाम पर कुछ पंजीकरण मांगेगा, जैसे यदि आपके व्यवसाय का नाम आपके व्यवसाय बैंक खाते की तुलना में “मेरा अध्ययन” होना चाहिए के “MY STUDIO”नाम पर

एक विज्ञापन व्यवसाय के रूप में एक नए स्वामित्व वाली फर्म पंजीकरण केआप उद्योग आधार पंजीकरण प्राप्त कर सकते हैं और अपने बैंक को अपने केवाईसी दस्तावेज के साथ अपना आधार पंजीकरण पंजीकरण प्रमाण पत्र प्रस्तुत कर सकते हैं जिसमें आप बैंक खाता खोलना चाहते हैं। अपनी फर्म का नाम।

अब आप अपनी कंपनी के तहत प्रोपराइटरशिप फर्म के तहत फर्म बैंक खाते में भुगतान स्वीकार करके अपना व्यवसाय शुरू करते हैं।

अब आपको व्यक्तिगत नाम के तहत अपना आयकर रिटर्न दाखिल करना होगा क्योंकि व्यवसायिक आय प्रारंभिक आधार और आवश्यक करों का भुगतान करती है, यदि भुगतान करना आवश्यक है, तो प्रोपराइटरशिप फर्म के लिए अलग से पैन नंबर की आवश्यकता नहीं है, प्रोपराइटर का पैन नंबर पैन होगा एक फर्म की संख्या।

यदि आप एक ब्लॉग चलाते हैं, तो भी आपको प्रत्येक प्रकार के व्यवसाय के लिए अलग पंजीकरण प्राप्त करने की आवश्यकता नहीं होती है और उसी व्यवसाय या फर्म के तहत आप विज्ञापनों के लिए अपना भुगतान प्राप्त कर सकते हैं, या सेवाओं के लिए अन्य चालान कर सकते हैं।

साझेदारी फर्म:

यदि आप एक एकल विज्ञापन व्यवसाय, YouTube चैनल या ब्लॉग या किसी अन्य प्रकार के विज्ञापन व्यवसाय में चल रहे दो या अधिक व्यक्ति हैं, तो आपकोको परिभाषित

- लाभ साझाकरण अनुपात,

- पूंजी योगदान और

- अपने व्यवसाय मेंकार्यकरना होगा जिसके लिए आप यह कर सकते हैं

साझेदारी विलेख में विवरणों का उल्लेख करके कि लाभ साझा करने का अनुपात क्या होगा, प्रत्येक भागीदार द्वारा कितना पूंजी योगदान किया जाएगा और

फर्म के बैंक खाते को कैसे संचालित किया जाएगा, फर्म के बैंक खाते को किसी भी द्वारा संचालित किया जाएगा। फर्म या बैंक खाते के साझेदारों को फर्म के नाम से संयुक्त रूप से सभी भागीदारों द्वारा संचालित किया जाएगा

और साझेदारी फर्म शुरू करने के लिए निम्नलिखित चरणों का पालन करना आवश्यक है

- साझेदारी का मसौदा तैयार करना भागीदारी

- की डीड पर

- हस्ताक्षर करना साझेदारी का हस्ताक्षर

- करना पार्टनरशिप फर्म के पैन नंबर के लिए

- पंजीकरण दस्तावेजों पर हस्ताक्षर करना पंजीकरण

- फर्म के रजिस्ट्रार के साथ साझेदारी फर्म का पंजीकरण

एक बार सभी के लिए रैलियाँ अब पूरी हो चुकी हैं, आपको फर्म के नाम से एक बैंक खाता खोलना होगा और विज्ञापन शुल्क या किसी भी अन्य सेवाओं के लिए इनवॉइस के भुगतान को स्वीकार करना शुरू करना चाहिए, जिसमें शामिल हैं और साझेदारी विलेख।

एक साझेदारी फर्म की आय एक फर्म की आय है और साझेदार साझेदारी फर्म से पारिश्रमिक ले सकते हैं, साथी द्वारा प्राप्त पारिश्रमिक को एक व्यावसायिक आय के रूप में माना जाएगा और साझेदार

सीमित देयता भागीदारी (एलएलपी)

लिमिटेड देयता भागीदारी का हाथ है सीमित देयता के साथ साझेदारी के रूप में भी, सभी एलएलपी एक अलग कानूनी इकाई है।

LLP को कॉर्पोरेट मामलों के मंत्रालय द्वारा विनियमित किया जाता है और LLP का पंजीकरण भारत में केंद्रीय पंजीकरण केंद्र crc के लिए किया जाता है, LLP के अधिकार क्षेत्र राज्य की कंपनियों के रजिस्टर के साथ निहित होते हैं, जिसमें LLP का पंजीकृत कार्यालय

पंजीकरण के लिए प्रक्रिया है। सीमित देयता भागीदारी (एलएलपी)(साझेदारी साझेदारी के

- के डिजिटल हस्ताक्षर प्राप्त करने के लिए आवेदन

- एलएलपी समझौतेरूप में एक ही)

- सीआरसीसाथ आवेदन

- हस्ताक्षर और एलएलपी समझौते के मुद्रांकन केएलएलपी समझौते के

- एलएलपी पंजीकरण के 30 दिनों के भीतर आरओसी के साथदाखिल।

प्राइवेट लिमिटेड कंपनी

प्राइवेट लिमिटेड कंपनी व्यवसाय के लिए सबसे लोकप्रिय संरचना है। प्राइवेट लिमिटेड कंपनी बाहर से फंडिंग और फॉरेन डायरेक्ट इन्वेस्टमेंट की आसानी से अनुमति देती है।

प्राइवेट लिमिटेड कंपनियों के लिए बोर्ड मीटिंग, कॉर्पोरेट मामलों के मंत्रालय के साथ पंजीकृत सुरक्षित ऋण, महत्वपूर्ण मामलों के लिए सदस्यों की बैठक आयोजित करना, उनकी बोर्ड रिपोर्ट में महत्वपूर्ण मामलों के बारे में पूरा खुलासा करना आवश्यक है। कंपनी कानून द्वारा प्राइवेट लिमिटेड कंपनी पर लगाए गए इन सभी विनियामक खुलासों और आवश्यकताओं के कारण, वे एक सीमित देयता भागीदारी (एलएलपी), एक व्यक्ति कंपनी (ओपीसी) या सामान्य साझेदारी की तुलना में अधिक विश्वसनीयता के साथ देखे जाते हैं।

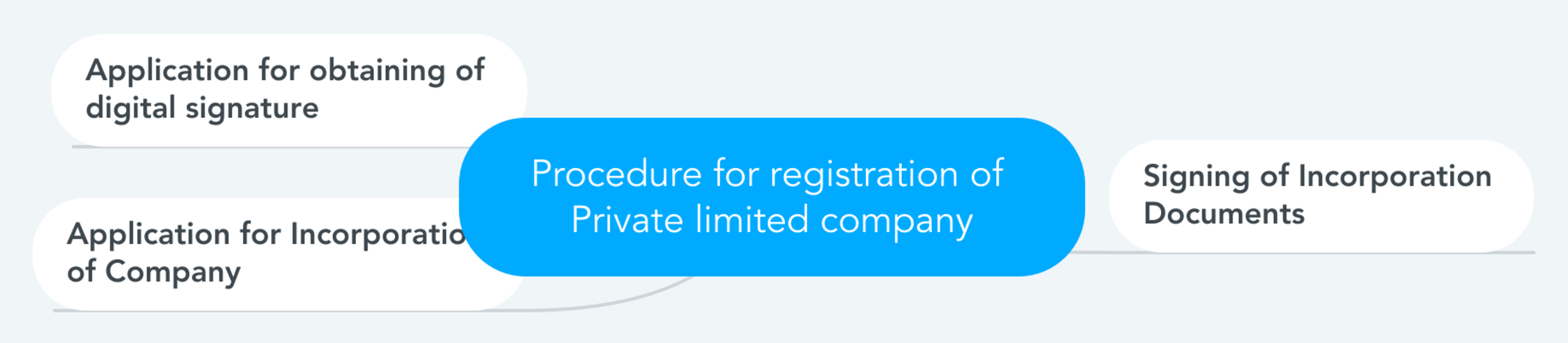

प्रक्रिया निजी लिमिटेड कंपनी के पंजीकरण के लिए

- डिजिटल हस्ताक्षर प्राप्त करने के लिए आवेदनहस्ताक्षर

- । निगमन दस्तावेजों पर

- कंपनी के निगमन के लिए आवेदन

इन दिनों भारत सरकार ने निजी कंपनियों के पंजीकरण को काफी हद तक सरल कर दिया है और अब निजी सीमित कंपनी के लिए आवेदक पैन कर सकते हैं। कंपनी का पंजीकरण प्रमाण पत्र प्राप्त करते ही TAN, ESIC EPFO और कंपनी का बैंक खाता।

निजी लिमिटेड कंपनी में दो या दो से अधिक व्यक्तियों की आवश्यकता होती है और इस अधिनियम में एक निदेशक और कंपनी के शेयरधारक होते हैं, जबकि निजी लिमिटेड कंपनी के रूप में एक व्यक्ति कंपनी को एकल व्यक्ति के साथ एकीकृत किया जा सकता है, जिसके पास एकल व्यक्ति होगा, जिसमें निदेशक और शेयरधारक होंगे। कंपनी का।

निदेशक और शेयरधारक कंपनी में एक ही या अलग-अलग व्यक्ति हो सकते हैं।

जीएसटी पंजीकरण

जीएसटी पंजीकरण उपरोक्त सभी व्यावसायिक संरचनाओं के लिए समान है, दो प्रकार के हैं और जीएसटी पंजीकरण एक अनिवार्य जीएसटी पंजीकरण है और अन्य अनिवार्य पंजीकरण के तहत स्वैच्छिक पंजीकरण है यदि आपका टर्नओवर एक विशेष वर्ष के 20 रुपये से अधिक है सीमा पार करने के 30 दिनों के भीतर पंजीकरण प्राप्त करें और यदि आवश्यक हो तो आप जीएसटी पंजीकरण स्वैच्छिक भी प्राप्त कर सकते हैं।

FASTLEGAL आपको सभी प्रकार के व्यवसायों के लिए व्यवसाय पंजीकरण और पेशेवर परामर्श सेवाएँ प्रदान करता है यदि आपको किसी भी प्रकार की सहायता की आवश्यकता हो तो आप सीधे हमसे 9782280098 पर संपर्क कर सकते हैं या हमें mail@fastlegal.in पर ईमेल कर सकते हैं।