MCA has recently introduced the new process for incorporation of LLP in India, this process was much awaited as company incorporation procedure with single e form and centralized processing with Central Registration Center (CRC) was already in place. Now LLP incorporation will also be done through CRC. Once the LLP is Incorporated the LLP Jurisdiction will vest with respective Registrar of Companyies (ROC) office.

How the New Incorporation procedure will work:-

- Name Approval Application in RUN-LLP (Reserve Unique Name – Limited Liability Partnership)- RUN-LLP is a web based e form , through which name approval application can be filed to CRC, Maximum two Name can be applied for approval. Before applying the name of LLP applicant must ensure that same login id will be used for filing the LLP Incorporation form.

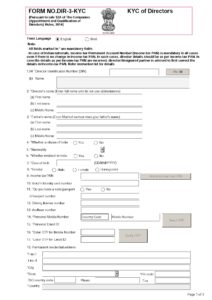

- Obtaining Digital Signature for Designated Partners of LLP: – Designated Partners are required to obtain DSC with Certifying Authority in India.

- LLP Incorporation application in Form FiLLiP (Form for incorporation of

Limited Liability Partnership) :- This LLP Incorporation form is for following services- a) Name reservation ( We can Directly Apply for Name Approval Application if we are sure to get the name, it is very much advisable to get the Name Approval first as the cost for Name Approval Application is Just Rs. 200/- , this will help us to file the Application confidently without worry of name approval.

b) Allotment of Designated Partner Identification Number(DPIN/DIN).

c) Incorporation of the LLP

- a) Name reservation ( We can Directly Apply for Name Approval Application if we are sure to get the name, it is very much advisable to get the Name Approval first as the cost for Name Approval Application is Just Rs. 200/- , this will help us to file the Application confidently without worry of name approval.

- Approval of LLP Incorporation form : Once the LLP Incorporation form get approved , LLP Incorporation Certificate will be issued by MCA and LLP is Registered.

- Drafting, Signing and Filing of LLP Agreement:- LLP is required to File LLP Agreement, duly signed, Stamped and notarized within 30 days of registration of LLP. Filing of LLP Agreement is Mandatory and late filing of form will cost you Rs. 100 per day.

- Application for PAN and TAN of LLP : PAN and TAN is must for every LLP as LLP is required to file its Income Tax Return and TDS return and is also required to quote the PAN for various transitions as prescribed under Income Tax Act and Rules. Unlike Companies where SPICE form for incorporation has facility to get PAN and TAN along with Certificate of Incorporation, LLP Form FiLLiP (Form for ncorporation of Limited Liability Partnership) do not have such facility right now, so PAN and TAN application is required to be made separately as soon as LLP gets incorporated.

Get Free Quote on LLP Registration

Call: +91-9782280098 , Email : Mail@fastlegal.in