How to Apply for Legal Registration for Youtube Channel Advertisement Business

If you run YouTube channel and earning money through advertisements or any other form you are required to register your YouTube channel as a business, Earning money through advertisements is an advertisement business and you must register your business with any of the business structures available for registration in India,

In this post I will let you know about the legal registration procedure for YouTube channel in India:

Choosing the right business structure or Firm:

In India the business can be done through various types of business structures available for the registration of an YouTube channel you must know about the available business structures:

Proprietorship firm business:

Proprietorship form any single individual who is doing business can register and firm under his own name the proprietorship firm will not be in a separate entity from its owner. If you are a single person and run a YouTube channel earning some money through advertisements on YouTube then you can register a proprietorship firm.

Registration of proprietorship firm is not mandatory in India but for opening open a bank account bank will ask you for or some registration in the name of your Business, e.g. If the Name of Your Business is “MY STUDIO” than your Business Bank account should be in the Name of “MY STUDIO”

Registration of a new proprietorship firm as an advertisement business you can obtain Udyog Aadhar registration and submit your Udyog Aadhaar registration certificate along with your KYC document to your Bank in which you want to open a bank account in the name of your firm.

Now you start your business under your firm by accepting payments to Firm Bank Account, under the Proprietorship firm.

Now you are required to file your income tax return under the personal name as business income early basis and pay required taxes, if required to be paid , There is no separate PAN number required for proprietorship firm, the PAN number of proprietor will be the PAN number of a firm.

Also if you run a blog then also you are not required to obtain the separate registration for each and every kind of business and under the same business or firm you can receive your payment for the advertisements, or other invoices for services.

Partnership Firm :

If you are two or more person running in a single advertisement business , YouTube Channel or blog or any other type of advertisement business , you have to define

- profit sharing ratio,

- capital contribution and

- work in your business for which you can do this

by mentioning the particulars in the partnership deed like what will be the profit sharing ratio how much capital contribution will be done by each partner and

how the bank account of the firm will be operated will the bank account of the firm will be operated by any of the partners of the firm or bank account will be operated by all of the partners jointly in the name of the firm

Registration and starting of a partnership firm following steps are required to be followed

- Drafting of partnership Deed

- Stamping of Partnership Deed

- Signing of Partnership Deed

- Applying for PAN no of Partnership Firm

- Signing of Registration documents

- Application of Registration of partnership firm with Registrar of Firm

Once all the formalities are completed now you are required to open a bank account in the name of the firm and start accepting the payment of invoices for advertisement fees or any other services which are included and the partnership deed.

Income of a partnership firm is a income of a firm and partners can take remuneration from the partnership firm, the remuneration received by the partner will be treated as a business income and the hand of partner

Limited Liability Partnership (LLP)

Limited liability partnership is the same as is the partnership with limited liability, all also LLP is a separate legal entity.

LLP is regulated by the Ministry of Corporate Affairs and the registration of LLP is done for Central registration centre crc in India, jurisdictions of the LLP vests with the register of Companies of the state in which the registered office of the LLP is situated

Procedure for registration of limited liability partnership (LLP) for Youtube Channel

- Application for obtaining of Digital Signature

- Drafting of LLP Agreement (Same as Partnership Deed)

- Application for Registration with CRC

- Signing and Stamping of LLP Agreement

- Filing of LLP Agreement with ROC within 30 Days of Registration of LLP

Private Limited Company

Private Limited Company is the most popular structure for businesses and startups. Private Limited Company allows outside funding & Foreign Direct Investment easily. Private Limited Companies are required to hold Board Meetings,Register Secured Loans with the Ministry of Corporate Affairs,Hold Members Meeting for Important matters,Make complete disclosures about important matters in their Board Report. Due to all these regulatory disclosures and requirements imposed on Private Limited Company by Company Law they tend to be viewed with more credibility than a Limited Liability Partnership (LLP), One Person Company (OPC), or General Partnership.

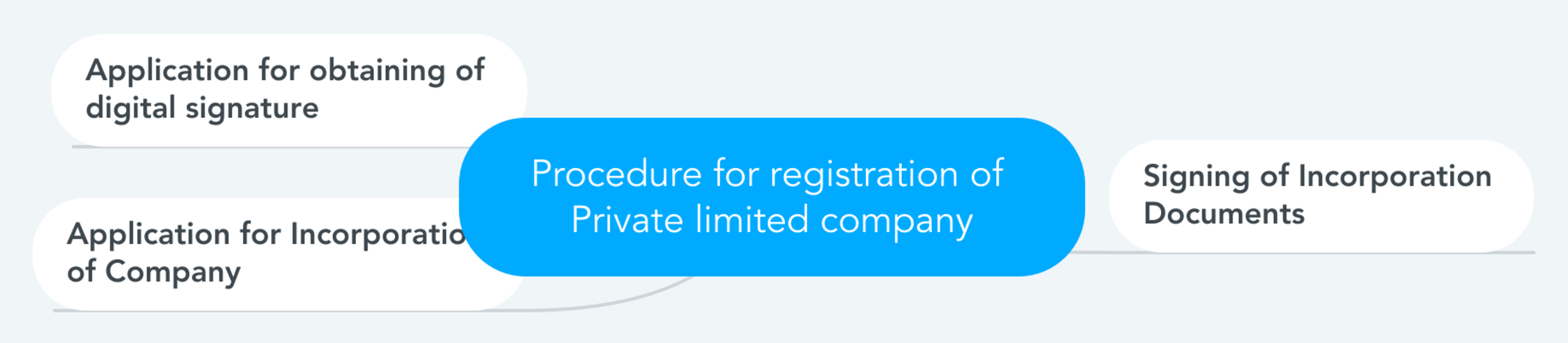

Procedure for registration of Private limited company for Youtube Channel

- Application for obtaining of digital signature

- Signing of Incorporation Documents

- Application for Incorporation of Company

These days the Government of India simplified the registration of private companies to much extent and now the applicants to the private limited company can now PAN, TAN, ESIC EPFO and bank account of the company as soon as they get the registration certificate of a company.

In private limited company two or more persons are required and the act has a directors and the shareholders of the company while the one person company as private limited company can also be integrated with the single person the single individual person will whole has a directorship and shareholder of the company.

Directors and shareholders can be the same or different persons in the company.

GST Registration

GST registration is the same for all of the above business structures, There are two types and the GST registration one is a compulsory GST registration and other is voluntary registration under compulsory registration if your turnover exceeds Rupees 20 lakin a particular year you have to obtain the registration within 30 days of crossing the limit and you can also obtain the GST registration voluntary if you required so.

Fastlegal provides business registration and professional Consulting Services to all type of businesses if you need any help you can directly contact us at 9782280098 or email us at mail@fastlegal.in